Proposition 19 recently passed in the Nov. 2020 election 51% to 49% and could have a major impact on farm & ranch estate planning.

Overview of Prop 19

Starting February 16, 2021, Prop 19 creates significant property tax changes for California property owners:

(A) severely limits the conditions under which property owners can transfer California residential and/or commercial real property to their children/grandchildren without triggering a property tax reassessment; and

(B) expands the ability of certain persons to preserve and transfer the assessed value of their primary residence to a replacement primary residence.

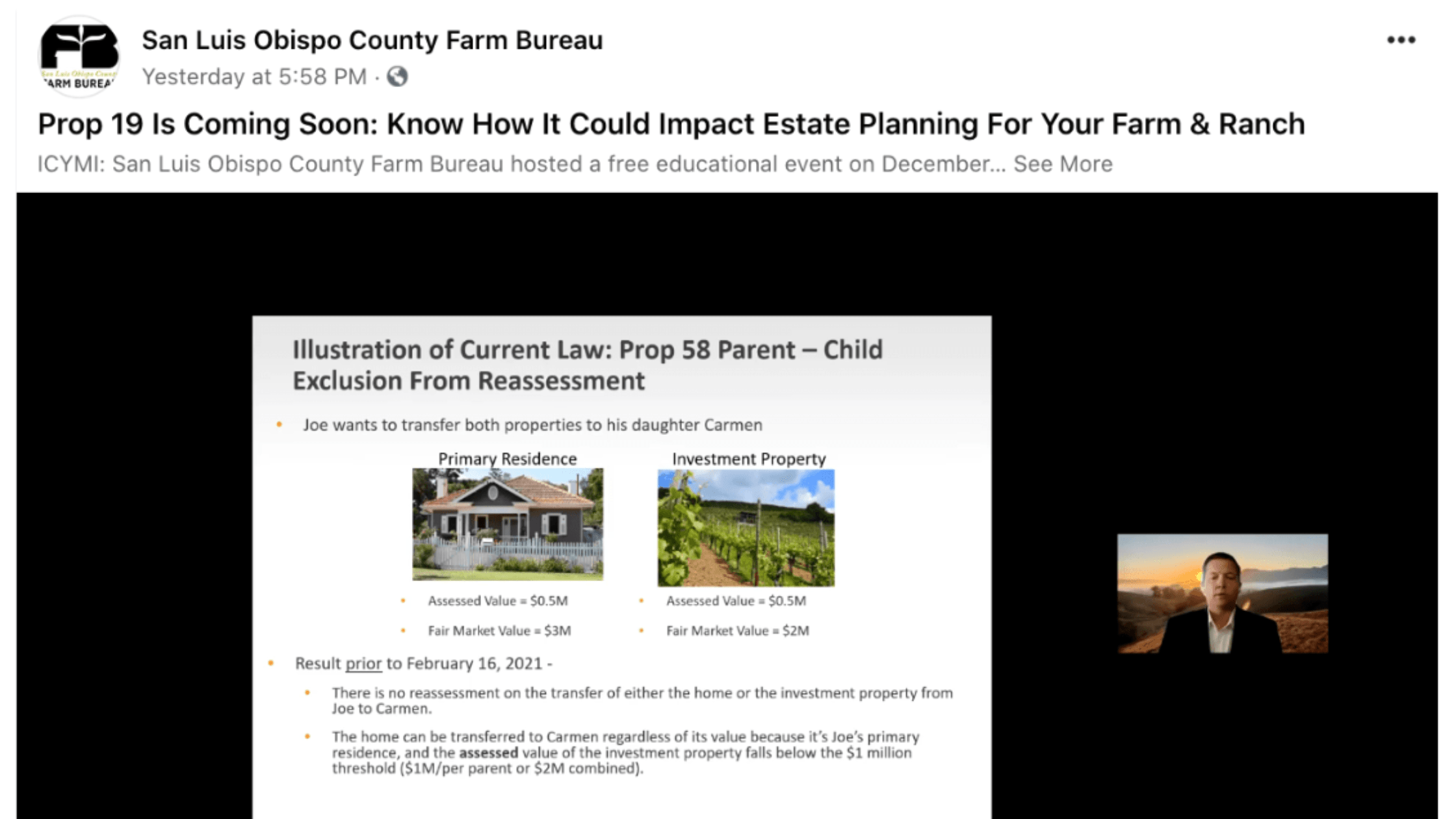

In the past, parents could transfer certain real property to children without a property tax reassessment.

Prop 19 could negatively impact parents’ ability to pass along the family farm and ranch to children.

Prop 19 Presentation

Joe Benson, one of our firm’s newest members, gave a presentation about how Prop 19 may increase one’s property tax liability. This potential increase means that Farm & Ranch estate planning should be modified to reflect the changes.

Parent-Child Exclusion:

- The current parent-child exclusion rules go away on February 15, 2021

- Contact your legal counsel now if you anticipate your children will keep rather than sell your/their CA property

- Property held in a Qualified Personal Residence Trust (QPRT) that has not yet terminated is not protected from Prop 19

- 1031 Exchange considerations –property tax savings vs. resetting value for depreciation purposes

- Transferring into an LLC with multiple children

- The parent-child exclusion rules discussed do not apply to properties held in legal entities such as limited liability companies, partnerships, and corporations.

- There is a separate set of rules for determining when there has been a change in ownership (and thus property tax reassessment) of properties held in legal entities.

- Property owners who hold title to California real estate in legal entities that they wish for their heirs to keep rather than sell should consult with legal counsel for analysis of how these rules apply in their circumstances.

- To avoid inadvertently triggering reassessment, property owners should also consult with legal counsel before transferring real estate into or out of legal entities, and before making intra-family transfers of interests in legal entities that own California real estate.

- “Family farm” means any real property which is under cultivation or which is being used for pasture or grazing, or that is used to produce any agricultural commodity, as that term is defined in Section 51201 of the Government Code as that section read on January 1, 2020.

Contact Legal Professional

The information provided herein does not, and is not intended to, constitute legal advice; instead all information, content, and materials are for general informational purposes only.

If you have any questions, please contact Carmel & Naccasha, and for more details, read our full disclaimer.